FinTech in Lithuania

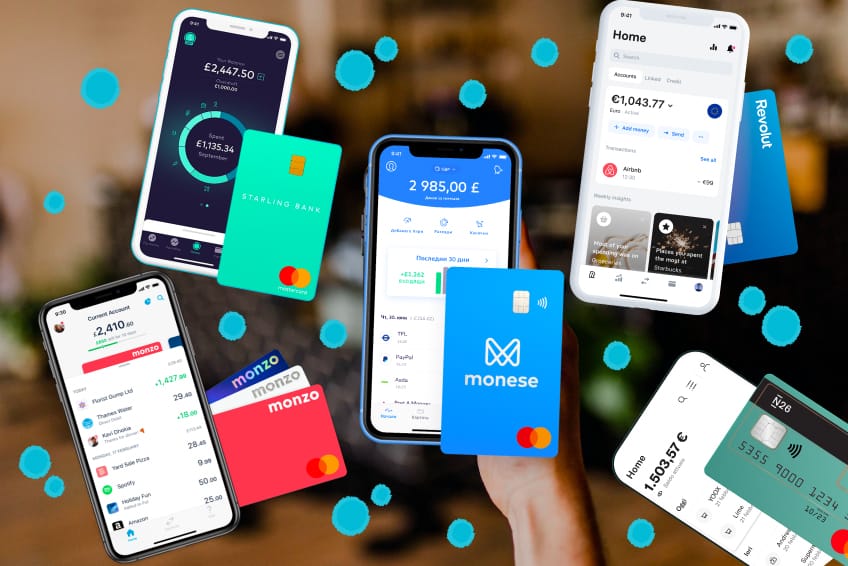

If you've been following the news then you'll be aware that FinTech in Lithuania has been soaring - they've been making moves to position themselves as one of the world's prominent FinTech hubs and the largest in the EU in terms of licensed companies. At first, Baltic state Lithuania, with a population of 2.7 million